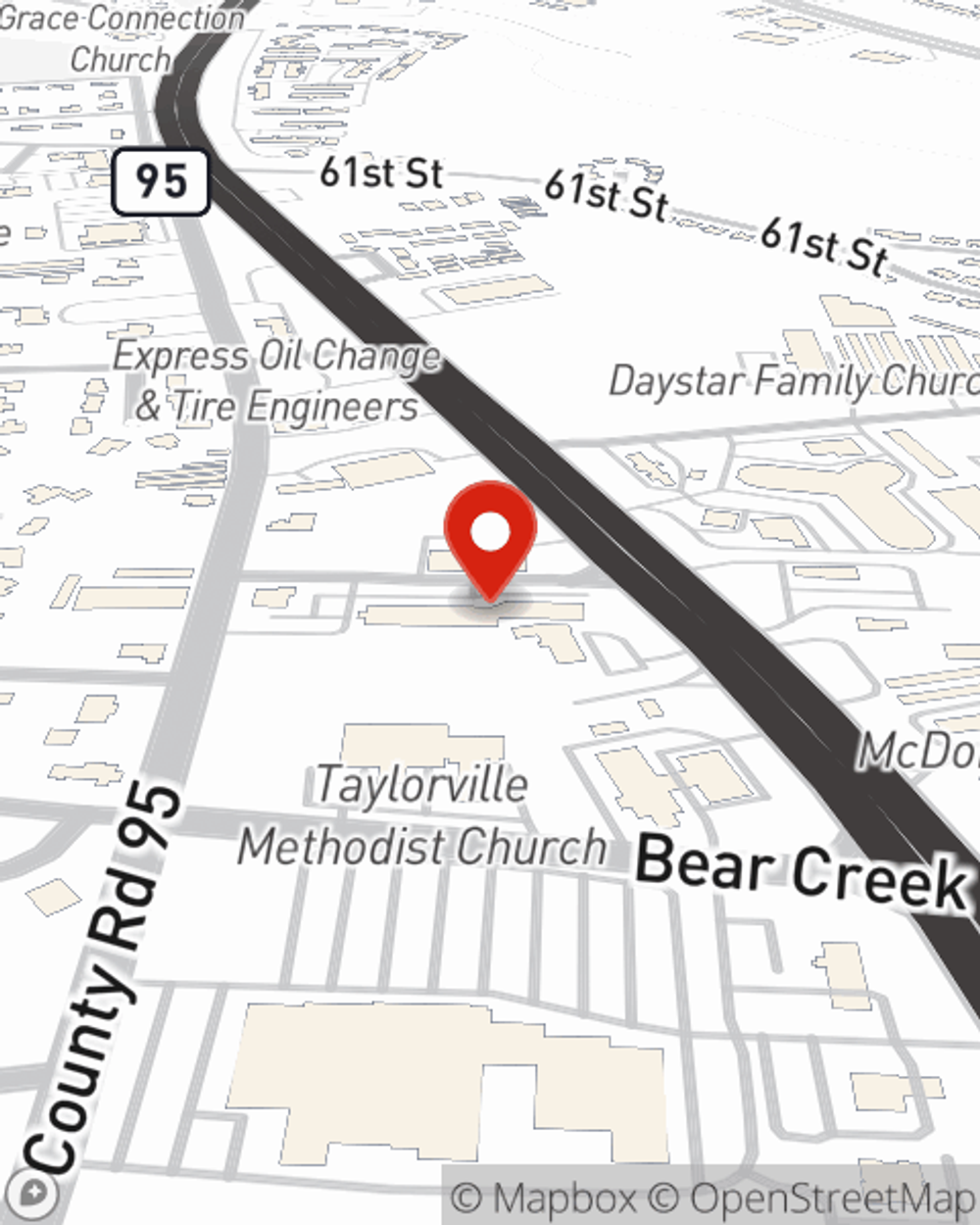

Business Insurance in and around Tuscaloosa

Looking for small business insurance coverage?

This small business insurance is not risky

- Tuscaloosa County

- Moundville

- Hale County

- Fosters

- Ralph

- Northport

- The Lakes Tuscaloosa

Cost Effective Insurance For Your Business.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Accidents happen, like an employee gets hurt on your property.

Looking for small business insurance coverage?

This small business insurance is not risky

Cover Your Business Assets

Planning is essential for every business. Since even your brightest plans can't predict natural disasters or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like business continuity plans and errors and omissions liability. Terrific coverage like this is why Tuscaloosa business owners choose State Farm insurance. State Farm agent Pam Marbut can help design a policy for the level of coverage you have in mind. If troubles find you, Pam Marbut can be there to help you file your claim and help your business life go right again.

Don’t let the unknown about your business keep you up at night! Call or email State Farm agent Pam Marbut today, and see how you can save with State Farm small business insurance.

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Pam Marbut

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.